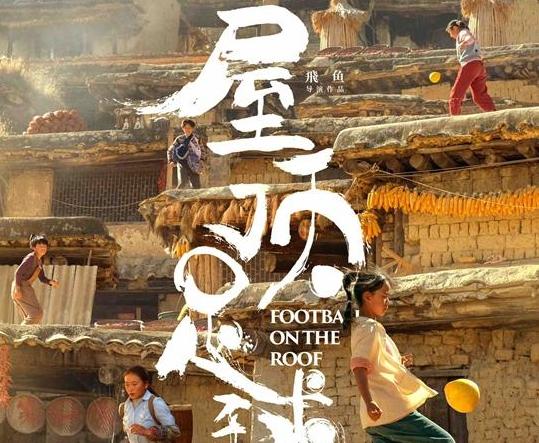

"Football on the Roof" director Fei Yu told China.org.cn that he wants to shed light on the lives and yearnings of rural children.

Booming high-tech fields have become important drivers of steady job growth in China, which is expecting to have a graduation class of nearly 11.79 million this year.

The China-Laos Railway had handled over 8 million tonnes of import and export goods as of Sunday, said Kunming Customs.

The Shenzhou-18 crewed spaceship is scheduled to be launched at 8:59 p.m. Thursday (Beijing Time) from the Jiuquan Satellite Launch Center.

Ukrainian President Volodymyr Zelensky said Tuesday that Ukraine would soon get the largest-ever military aid package from Britain worth 500 million pounds.

Tianjin Library has conducted ancient book restoration work for over 70 years.

General counsel Ross Wenzel points out USADA double standards.